Tesla has released Master Plan Part 3, outlining its proposal for achieving a sustainable global energy economy via end-use electrification and sustainable electricity generation and storage. (Earlier post.)

Tesla has estimated that the overall manufacturing cost for achieving this goal will be $10.4 trillion, which includes the cost of ensuring global deployment of 240 TWh of batteries. (This compares with an expected $14 trillion to be spent on fossil fuels at 2022 investment rates over the next 20 years.) Benchmark’s quick analysis suggests that Tesla’s $10.4 trillion figure may underestimate the cost of mining, refining, and chemicals.

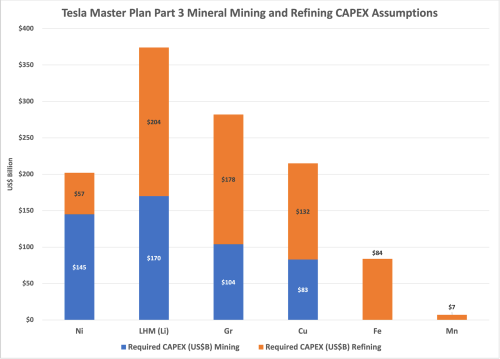

Tesla’s own modeling indicates that the total cost of mining and refining could reach up to $3.4 trillion. The majority of investments Tesla imagines are necessary for mining and refining lithium ($374 billion) and graphite ($282 billion).

Major CAPEX requirements by mineral for mining and refining in Tesla’s Master Plan Part 3.

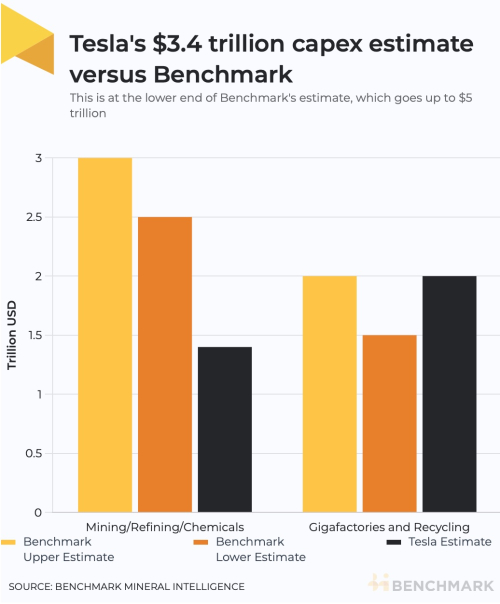

Tesla states that a total of $2.082 trillion in investment will be necessary for gigafactories for electric vehicles and energy storage, as well as for recycling. This estimate is in line with Benchmark’s own estimate of $1.5 to $2 trillion.

Tesla’s estimate of $1.4 trillion for mining, refining, and chemicals investment falls below Benchmark’s lower bound estimate of $2.5 trillion and is only half of Benchmark’s upper bound estimate of $3 trillion.

“Let’s not make the same error we made with gigafactories, with all the money for them and none for mining. The industry needs joined up thinking.”

–Simon Moores, Benchmark CEO

Tesla’s estimate of $1.4 trillion for mining, refining, and chemicals investment falls below Benchmark’s lower bound estimate of $2.5 trillion and is only half of Benchmark’s upper bound estimate of $3 trillion.